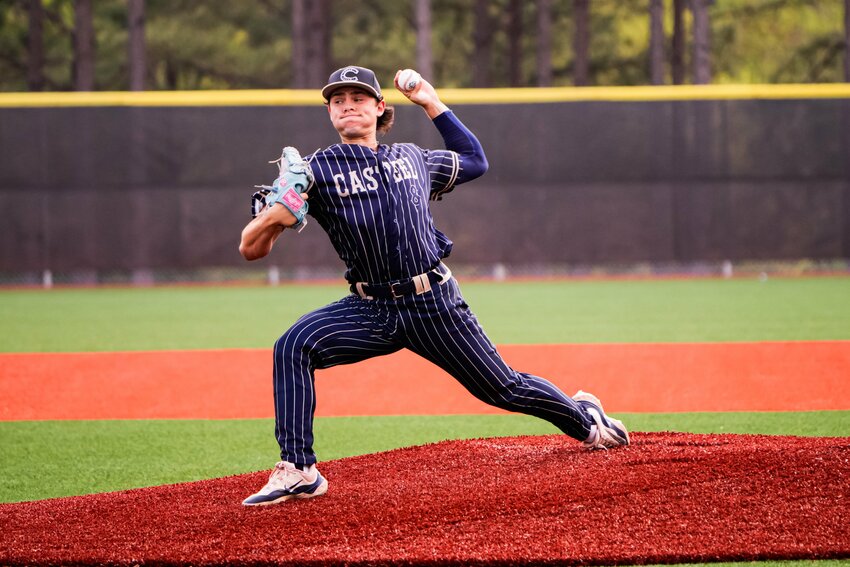

HIGH SCHOOL BASEBALL

A couple weeks before Casteel baseball started the playoff defense of its 5A state title, the Colts traveled to Cary, N.C. to play in the National High School Invitational.

Casteel went 3-2 over …

Business

Black Rock Coffee Bar, known for its premium roasted coffees, teas, smoothies and Fuel energy drinks is holding a soft launch this weekend for its latest Arizona location, this one in San Tan Valley.

…

Parks & Recreation

Opening day is getting closer for Frontier Family Park and some new residents already are calling the place home.

On Thursday, the Queen Creek Parks & Recreation Department began stocking …

Crime

The Pinal County Sheriff’s Office has arrested a man in Mesa in connection with a non-fatal shooting in San Tan Valley.

At around 1:10 a.m., March 29, PCSO was called to a home off Gantzel …

Public Safety

The Queen Creek Police Department will be o hand to help residents safely dispose of prescriptio drugs.

If you have unused or expired prescription drugs that you're not sure what to …

News

FUSD

Students at schools in the Florence Unified School District who take after-hours extracurricular activities will have to find new ways to get back home.

FUSD has announced that beginning in the …

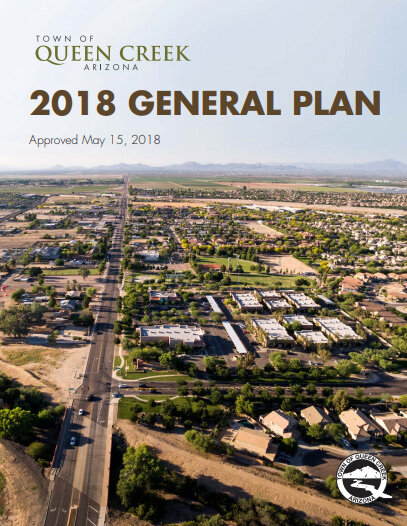

General Plan

The town of Queen Creek is currently considering a major General Plan amendment that if approved, would provide potential opportunities to consider limited commercial development within the Rural …

Education

Meta, the parent company of Facebook, recently donated $24,000 to support a technology program at Queen Creek Elementary. The donation was approved during the Queen Creek Unified School District …

Middle School

On Monday, members of an exploratory committee with the Florence Unified School District will be discussing plans for the district to transition to a middle-school model.

The meeting take …

Education

The Cortina Elementary Rad Dadz group formed organically, bonding over shared interests.

Rad Dadz is a group focused on friendship and active involvement in their children's school. It's a …

Earth Month

Monday is the last day to register for a Fast Pass for this month’s QC Recycles drive-thru event.

The event starts at 7 a.m., Saturday, April 20 at the Queen Creek Field Operations …

Read more