Country Thunder

The Pinal County Attorney’s Office was off and running on the first day of Country Thunder on Thursday by educating festival attendees about the dangers of drinking and driving.

By early …

Roadways

Solar roadway lighting is allowing the Queen Creek Public Works Department to find lighting solutions for different locations around the town.

Solar roadway lights:

Bring visibility …

Elections

Congressional District 5 covers an area seen as strongly Republican with one of the most visible members of the House Freedom Caucus holding the seat.

But that has not stopped a newcomer from …

Holiday Events

Some residents are showing support and others are opposing Queen Creek’s decision to drop the Trunk or Treat Halloween event this year.

“After careful consideration, effective this …

Honor

Ramona Simpson, the town’s environmental and fleet operations manager, has been recognized for her dedication and exceptional work in implementing sustainable waste management practices.

…

News

SUMMER PREPARATION

Pinal County Air Quality is only issuing three-day open burning permits, and officials announced all permits will expire by May 1.

Pinal County will suspend the issuance of all open burning …

Neighbors

Karen Banda and Rebecca Olivera have been named recipients of the "Women in Engineering Scholarship" at Central Arizona College.

They both credit Armineh Noravian, professor of engineering at …

DISTRICT 15 Senate

Candidates officially filed their petitions April 1 to run in the 2024 primary election for Arizona State Senate District 15.

District 15 includes a portion of Mesa including Phoenix-Mesa …

DISTRICT 15 House

Candidates officially filed their petitions April 1 to run in the 2024 primary election for Arizona State House District 15.

District 15 includes a portion of Mesa including Phoenix-Mesa Gateway …

Election 2024

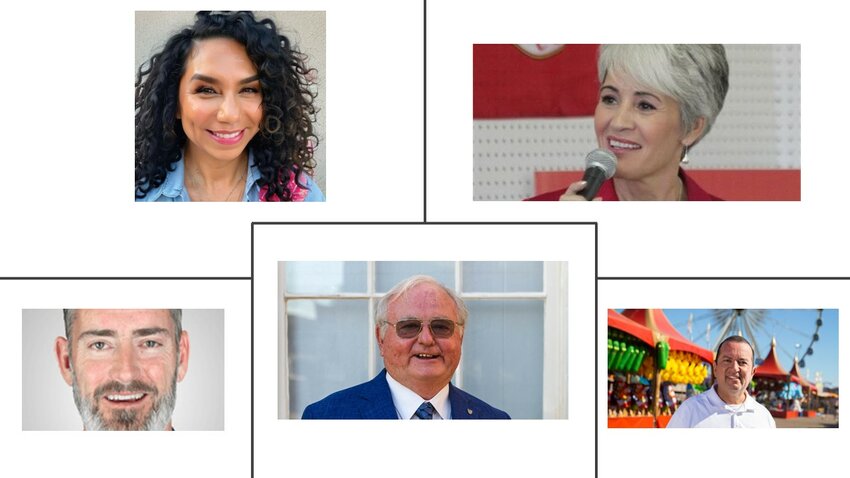

Arizona's 16th legislative district is one of 30 in the state, consisting of sections of Maricopa, Pima and Pinal counties. It was created in January 2022.

Meet the 2024 LD 16 state …

Election 2024

Arizona's 16th legislative district is one of 30 in the state, consisting of sections of Maricopa, Pima and Pinal counties. It was created in January 2022.

Meet the 2024 LD 16 state senate …

Read more