Parks & Recreation

Opening day is getting closer for Frontier Family Park and some new residents already are calling the place home.

On Thursday, the Queen Creek Parks & Recreation Department began stocking …

Crime

The Pinal County Sheriff’s Office has arrested a man in Mesa in connection with a non-fatal shooting in San Tan Valley.

At around 1:10 a.m., March 29, PCSO was called to a home off Gantzel …

Public Safety

The Queen Creek Police Department will be o hand to help residents safely dispose of prescriptio drugs.

If you have unused or expired prescription drugs that you're not sure what to …

FUSD

Students at schools in the Florence Unified School District who take after-hours extracurricular activities will have to find new ways to get back home.

FUSD has announced that beginning in the …

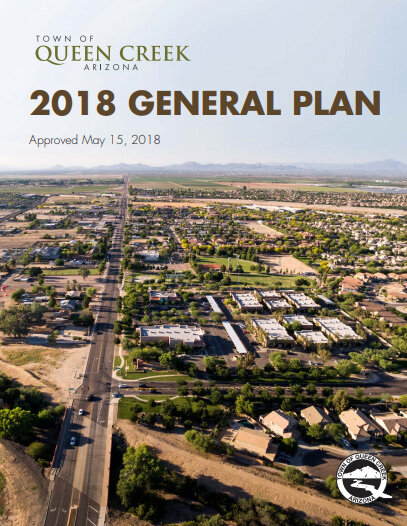

General Plan

The town of Queen Creek is currently considering a major General Plan amendment that if approved, would provide potential opportunities to consider limited commercial development within the Rural …

News

Education

Meta, the parent company of Facebook, recently donated $24,000 to support a technology program at Queen Creek Elementary. The donation was approved during the Queen Creek Unified School District …

Middle School

On Monday, members of an exploratory committee with the Florence Unified School District will be discussing plans for the district to transition to a middle-school model.

The meeting take …

Education

The Cortina Elementary Rad Dadz group formed organically, bonding over shared interests.

Rad Dadz is a group focused on friendship and active involvement in their children's school. It's a …

Earth Month

Monday is the last day to register for a Fast Pass for this month’s QC Recycles drive-thru event.

The event starts at 7 a.m., Saturday, April 20 at the Queen Creek Field Operations …

Public Safety

The Queen Creek Police Department is currently hiring police officer recruits.

“QCPD is seeking recruits who align with the organization’s philosophy of community-based policing and …

Country Thunder

The Pinal County Attorney’s Office was off and running on the first day of Country Thunder on Thursday by educating festival attendees about the dangers of drinking and driving.

By early …

Read more