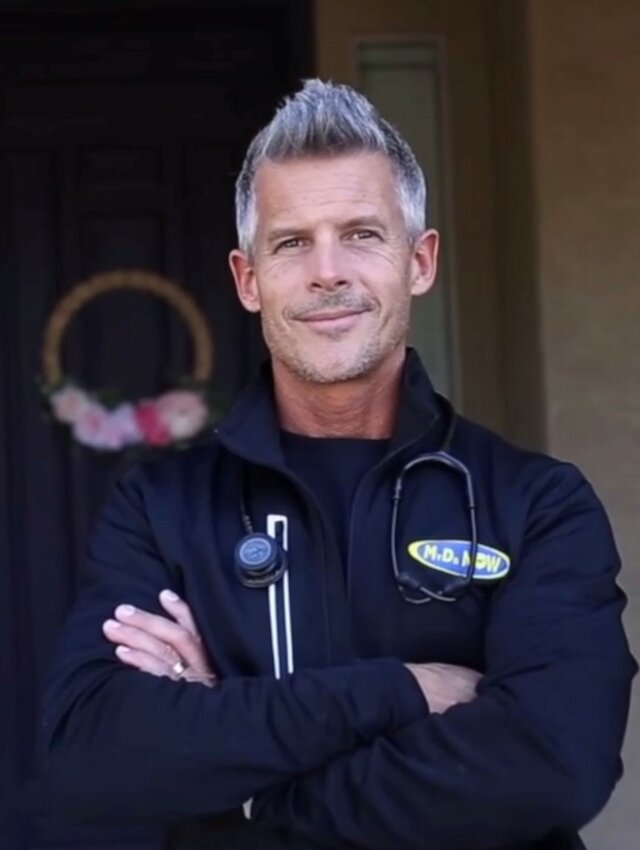

Hometown Hero

For physician’s assistant John Shipp, family, the community, giving back and caring for patients are important hallmarks of this life.

Shipp and his …

Parks

Phase 2 of the Mansel Carter Oasis Park expansion is progressing as summer draws ever closer.

The expansion will bring six sand volleyball courts, four pickle ball courts and six tennis courts. …

Things to do

Join the Pinal County Parks and Trails Department Wednesday and Thursday in removing invasive plant species from Peralta Regional Park, 17975 Peralta Road in Gold Canyon.

Volunteers will be …

Things to do

International Dark Skies week may be over, but the dark sky adventures continue. With the success of the first hike during Dark Skies Week, Pinal County Parks & Trails will host a dark sky guided …

Country Thunder

If you went to Country Thunder in Florence and now can’t find your keys, wallets or phones, the Pinal County Sheriff’s Office may have them.

Country Thunder took place April 11-14 at …

News

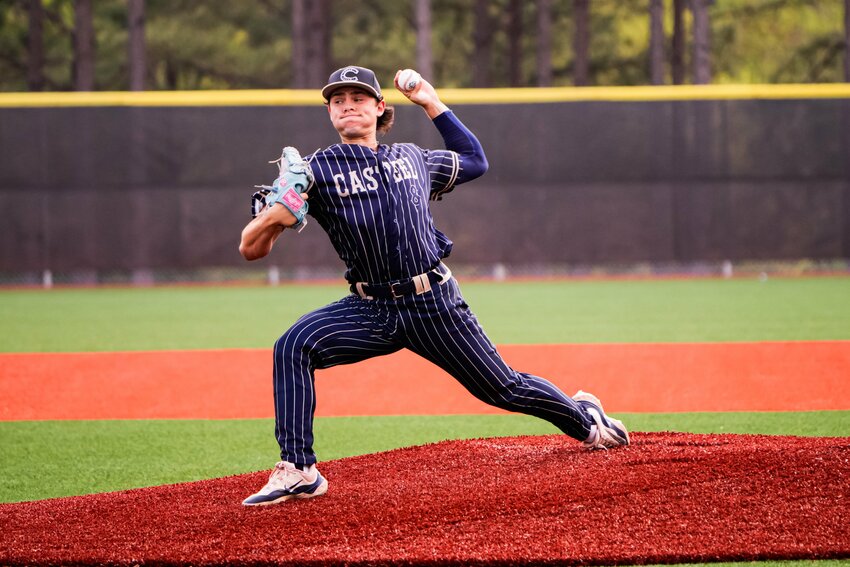

HIGH SCHOOL BASEBALL

A couple weeks before Casteel baseball started the playoff defense of its 5A state title, the Colts traveled to Cary, N.C. to play in the National High School Invitational.

Casteel went 3-2 over …

Business

Black Rock Coffee Bar, known for its premium roasted coffees, teas, smoothies and Fuel energy drinks is holding a soft launch this weekend for its latest Arizona location, this one in San Tan Valley.

…

Parks & Recreation

Opening day is getting closer for Frontier Family Park and some new residents already are calling the place home.

On Thursday, the Queen Creek Parks & Recreation Department began stocking …

Crime

The Pinal County Sheriff’s Office has arrested a man in Mesa in connection with a non-fatal shooting in San Tan Valley.

At around 1:10 a.m., March 29, PCSO was called to a home off Gantzel …

Public Safety

The Queen Creek Police Department will be o hand to help residents safely dispose of prescriptio drugs.

If you have unused or expired prescription drugs that you're not sure what to …

FUSD

Students at schools in the Florence Unified School District who take after-hours extracurricular activities will have to find new ways to get back home.

FUSD has announced that beginning in the …

Read more